FDA’s “Green List” for GLP-1 APIs: Regulatory Innovation or Symbolic Gesture?

In September 2025, the U.S. Food and Drug Administration unveiled a novel regulatory tool address concerns related to imported active pharmaceutical ingredients (APIs) for GLP-1 (glucagon-like peptide-1) drugs. Branded as the “green list,” the import alert (66-80) seeks to streamline entry of APIs from inspected, compliant sources while detaining those from unverified manufacturers. The move follows increased regulatory and public attention on compounded versions of GLP-1 therapies, which are not subject to FDA drug approval. (FDA Press Release)

But while the FDA frames the green list as a patient safety measure, some pharmacists, compounding advocates, and industry observers have expressed skepticism regarding the practical impact of the initiative.

What the Green List Does

1. Import Alert Targeted at GLP-1 APIs

Under the new import alert, GLP-1 APIs entering the U.S. from facilities not on the green list are subject to automatic detention without physical examination. Only imports from facilities that the FDA has inspected or, in some cases, evaluated remotely and deemed compliant are eligible for smoother entry. (FDA Press Release)

In its public announcement, the FDA tied the move directly to safety: “By strengthening oversight of imported APIs and cracking down on illegal drugs entering the U.S., we are taking aggressive action to protect consumers from poor-quality or dangerous GLP-1 drugs,” said Commissioner Marty Makary.

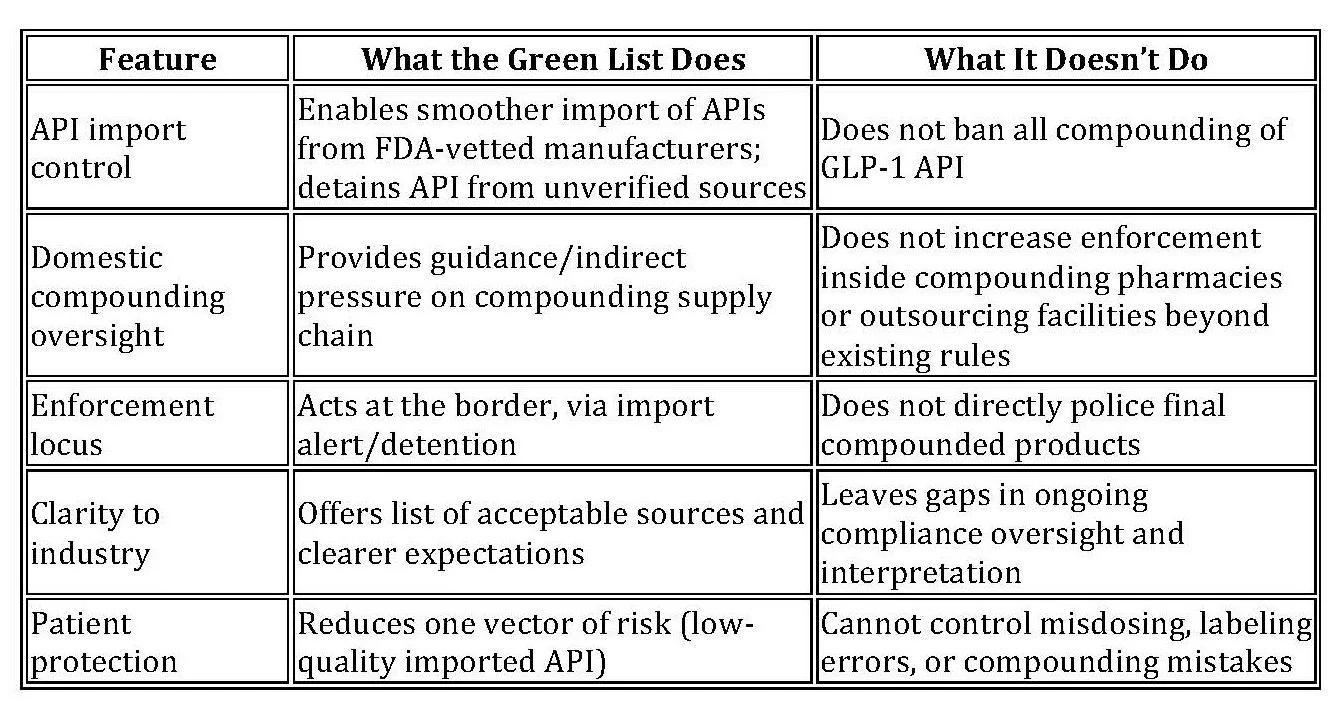

2. No New Prohibition on Compounding

Importantly, the green list does not ban the compounding of GLP-1 therapies per se. The FDA states that the import alert “does not create any new limits on the legal compounding of GLP-1 drugs.” The agency continues to maintain that compounded drugs are not FDA-approved and should only be used when a patient’s medical needs cannot be met by approved options.

In other words, compounders that use API from certified, inspected sources may continue to compound GLP-1 therapies (subject to existing state and federal compounding rules).

3. Enforcement and Border Control Focus

The green list directs enforcement energy to the border: detaining shipments, scrutinizing manufacturing sources, and conducting foreign inspections or remote assessments. In practice, the FDA says it assessed 48 manufacturing sites (domestic and foreign) and found that roughly 21% were noncompliant under the Federal Food, Drug, and Cosmetic Act.

Supportive Arguments: Why Some Applaud the Move

A. Patient Safety as Core Driver

Proponents argue the green list addresses a real risk: compounded GLP-1 products sourced from non-compliant suppliers could present potential risks such as dosing inconsistencies, contamination, or labeling issues. The FDA has received adverse event reports tied to compounded semaglutide and tirzepatide products—some involving hospitalization. In one case, a compounded tirzepatide product bore the name of a pharmacy that did not exist.

By making it harder to bring in low-quality API, supporters argue that restricting certain API imports may reduce the risk of substandard materials entering the supply chain.

B. Bringing Clarity to API Sourcing

Some observers view the green list as offering more clarity to compounding pharmacies about acceptable sources of GLP-1 APIs. BakerHostetler suggested the move “simplifies import of compliant GLP-1 API for pharmacy compounding.” In a complex global supply chain, having a vetted list could reduce ambiguity and help compounders avoid inadvertent regulatory traps.

C. Symbolic Shift Toward More Proactive Border Controls

Even critics concede that the green list signals an important shift in FDA strategy: rather than chasing illicit compounded products after the fact, the agency is trying to intercept questionable raw materials upstream. In that sense, the green list is a more surgical, risk-based enforcement tool.

Critical Views: Why Many Question the Impact

1. Industry Groups Raise Questions About Practical Applicability

The Alliance for Pharmacy Compounding (A4PC) promptly criticized the green list as misdirected. In their view, FDA doesn’t understand how compounders obtain APIs through legitimate, licensed wholesalers, and the import alert concept doesn’t meaningfully affect state-licensed pharmacies already vetting suppliers. “In reality, it doesn’t affect legitimate compounders,” A4PC argues.

Some in the compounding community suggest the green list may be more symbolic than practical—focusing on illicit online operators while offering limited impact on day-to-day pharmacy practice.

2. Enforcement Gaps and Practical Challenges

Even supporters of the green list acknowledge that border detention is an imperfect tool. For example:

Evasion is possible. Illicit suppliers may cleverly re-route imports under different product names or through intermediary firms.

Limited inspection scalability. The FDA may not have resources to inspect all candidate foreign API sites.

Delayed or retroactive audits. Some facilities may gain green list status but later diverge from compliance.

Domestic compounding controls remain weak. The green list does not address enforcement within U.S. compounding pharmacies or outsourcing facilities beyond existing frameworks.

Analysts at BMO Capital Markets noted that while the green list helps limit import risks, it does not confront the root supply of compounded GLP-1 production or illegal sales. (BioSpace)

3. Mixed Signals to Industry

Some stakeholders note that the green list may create mixed signals, leaving uncertainty about how compounding fits within FDA’s broader regulatory framework. The FDA, for its part, avoided overtly condemning compounding in its announcement, prompting interpretation that some degree of compounding will continue to be tolerated. (Washington Post)

Stakeholder Reactions

Brand-Name Makers

Pharmaceutical giants whose GLP-1 drugs dominate the market have long opposed certain compounding practices. They argue compounding threatens safety, undermines investments in clinical trials, and competes unfairly. In light of the green list, both companies have lauded the step as a partial win—but continue to press for stronger enforcement or outright prohibition on compounders. (Reuters)

Compounding Pharmacies & Outsourcing Facilities

Compounding stakeholders have mixed feelings. Some see potential benefit in clearer supply chain guidance; others warn that implementation will disadvantage smaller compounding pharmacies that lack the scale or resources to qualify their API suppliers. A4PC, representing many compounding operations, views the green list as largely irrelevant to properly licensed pharmacies.

Regulators and State Boards

State pharmacy boards and compounding oversight agencies may welcome a federal tool that helps screen out egregious API importers. But the green list does not affect state regulations over compounding practice, meaning coordination will remain essential.

Patients and Healthcare Providers

For patients using compounded GLP-1 products, the green list offers a measure of added protection (if their pharmacy uses accepted API). The FDA continues to emphasize that compounded drugs have not undergone FDA approval and should be used in limited circumstances. The FDA also continues to counsel that compounded drugs should be used only when no approved alternative exists.

What the Green List Means (and Doesn’t)

In short: the green list is a supply-chain tool, not a panacea for compounding risks. Its ultimate efficacy depends on how comprehensively the FDA audits API sources, how rigorously oversight is maintained post-listing, and how effectively state and federal regulators coordinate downstream enforcement.

What to Watch Going Forward

Which manufacturers get green-listed—and with what conditions. Observation of the first cohort may reveal how strict FDA standards really are.

How often listings will be audited or revoked. A static list risks stagnation; a dynamic system will better protect against backsliding.

Whether FDA ties green list membership to reimbursement or trust signals. If insurers or health systems begin requiring adherence to green-listed APIs, that would amplify impact.

Legal challenges from compounding industry. Some parties may argue procedural overreach or lack of guidance on compounding’s legality under the green list framework.

State–federal coordination. States may adopt their own rules referencing the green list, or adjust licensing to align with FDA expectations.

Adverse event reporting and transparency. Monitoring real-world safety of compounded GLP-1 therapies will help validate (or challenge) the import control approach.

Restore Health Consulting: How We Can Help

At Restore Health Consulting, we specialize in regulatory strategy, supplier qualification, and risk management for pharmacies and outsourcing (503B) facilities. In the wake of FDA’s green list rollout, these developments highlight the operational and compliance questions pharmacies may need to evaluate. Here’s how we can assist:

Supplier qualification & audit readiness. We help pharmacies and outsourcing facilities assess API suppliers against FDA expectations, coordinate audits or remote assessments, and prepare for inclusion in green list–friendly supply chains.

Gap analysis & remediation planning. We evaluate existing quality systems, documentation, and compliance frameworks, and help implement corrective action plans to meet evolving FDA and industry norms.

Regulatory intelligence & policy strategy. We monitor FDA guidance, import alerts, and compounding policy shifts—and help our clients position strategies that anticipate change.

Workflow design for compliance. We assist with designing internal procedures, sourcing protocols, and documentation workflows to maintain traceability and defensibility under audit.

Training & preparedness. We deliver tailored training to pharmacy leadership, quality staff, and operations on API vetting, risk assessment, and regulatory compliance.

If you’re a pharmacy or outsourcing facility trying to align with FDA’s new paradigm around GLP-1 APIs—and address compliance considerations while maintaining operational continuity—Restore Health Consulting is ready to be a partner. We’d be happy to walk you through a high-level roadmap of how we approach supplier qualification, audit readiness, and program integration to ensure you stay ahead of regulatory turbulence.

Disclaimer: This article is intended to provide general information on recent FDA actions related to GLP-1 compounding and supply chain oversight. It should not be construed as legal, regulatory, or medical advice. Readers are encouraged to consult an attorney for guidance specific to their circumstances.